tax avoidance vs tax evasion examples

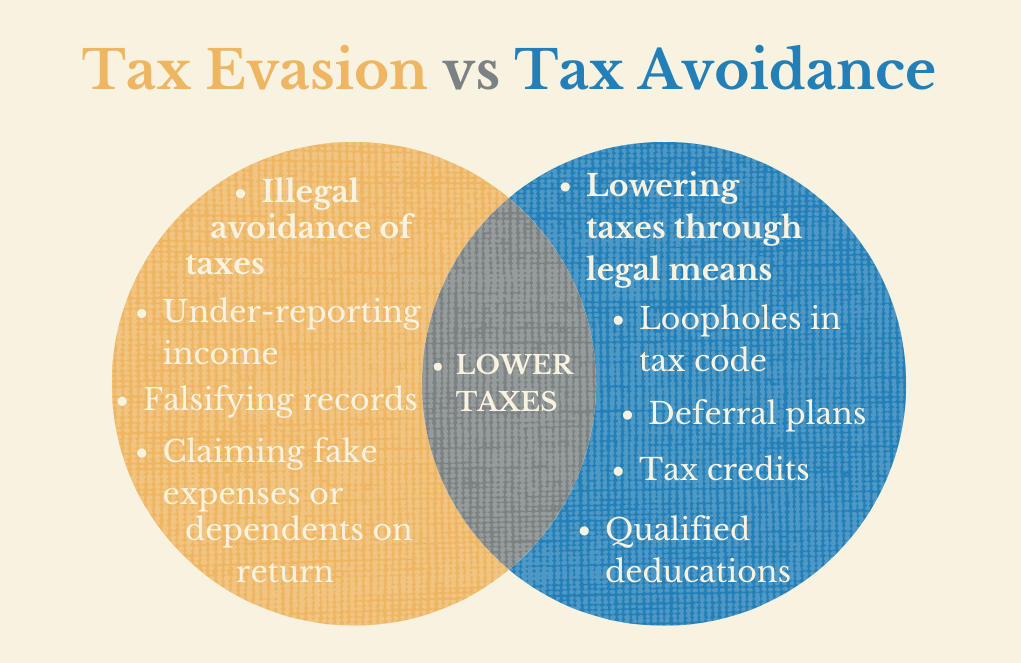

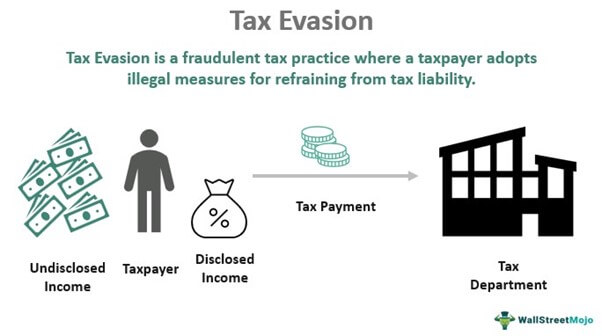

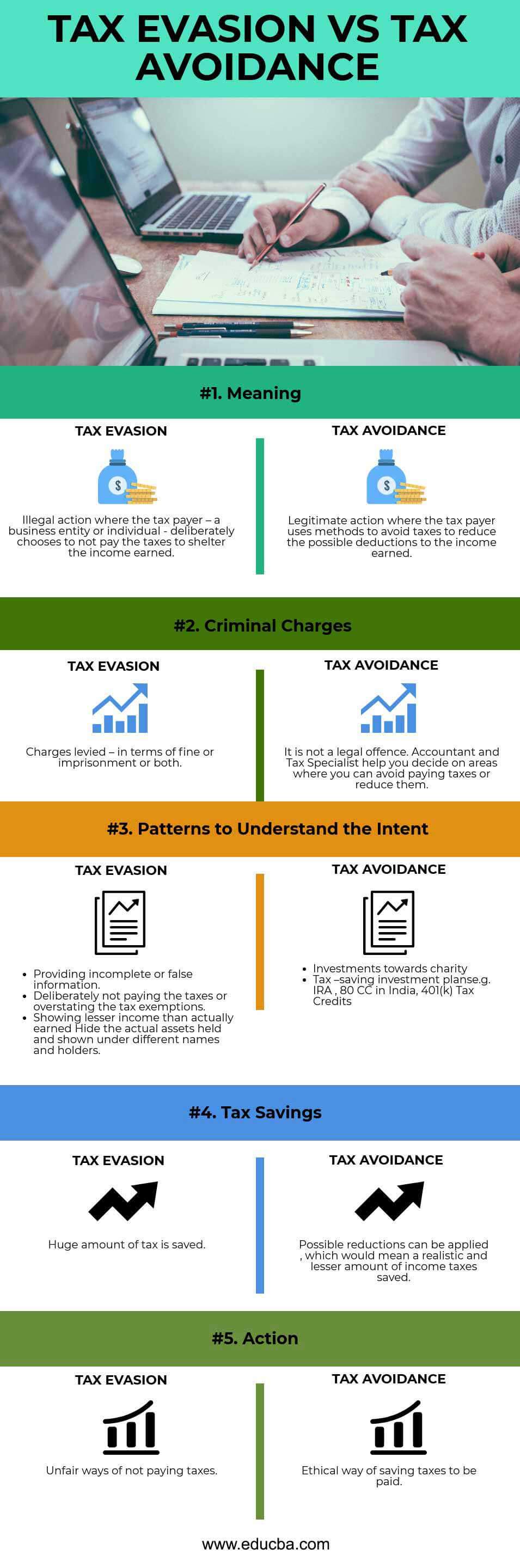

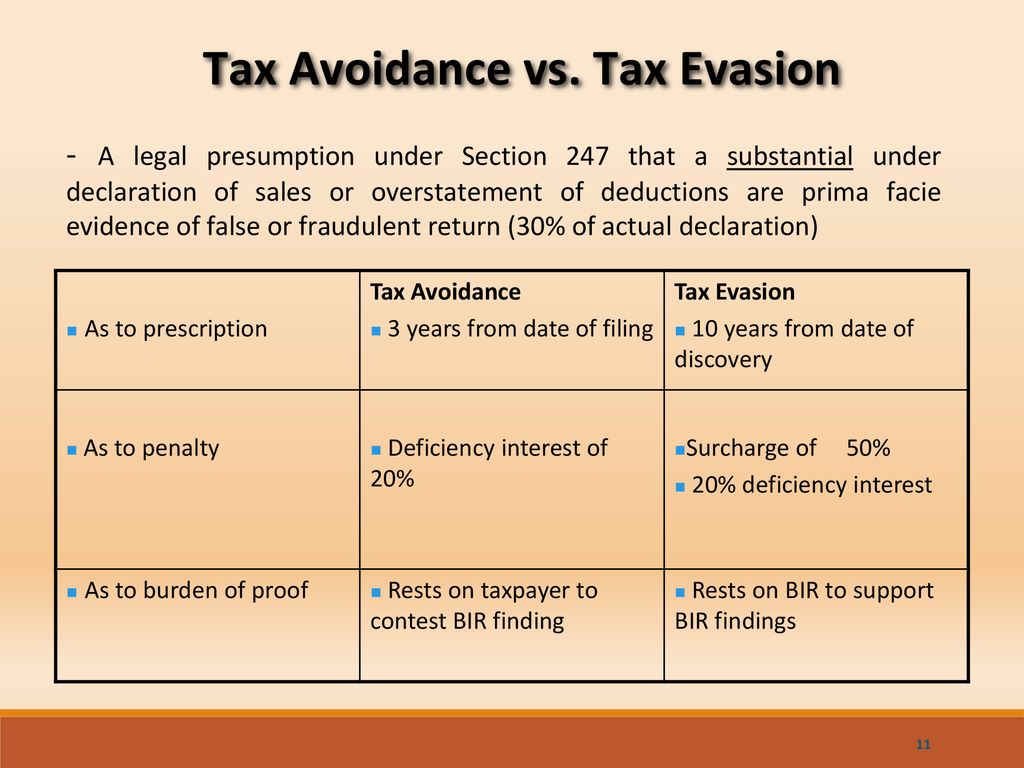

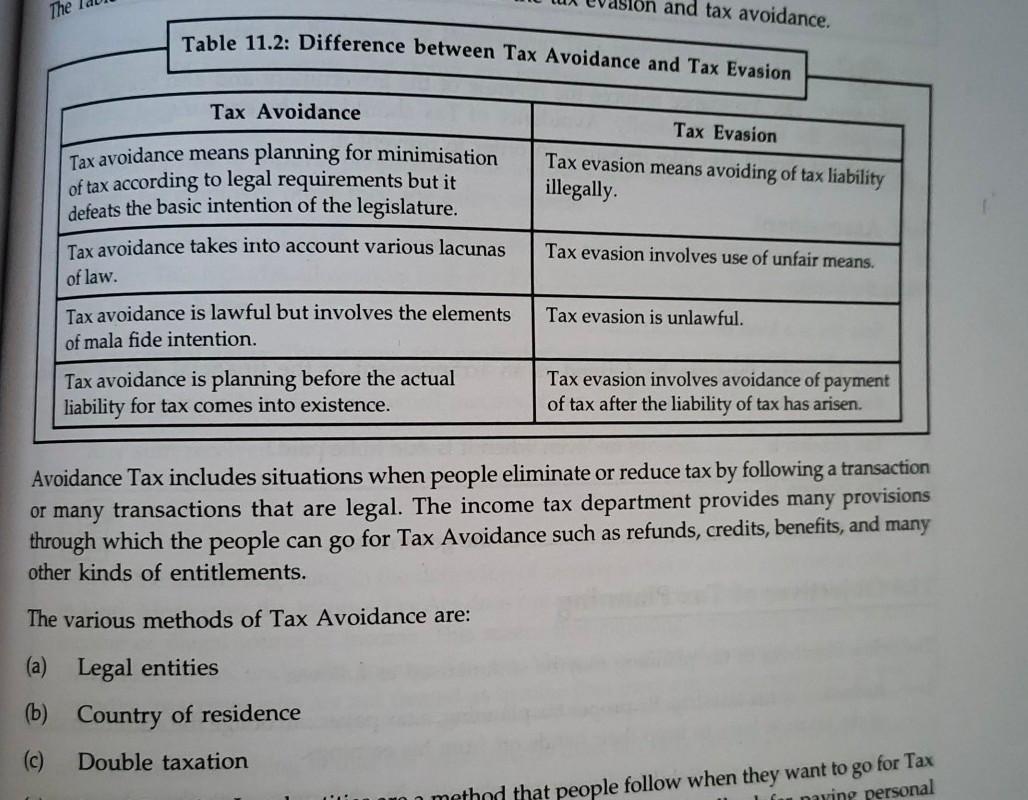

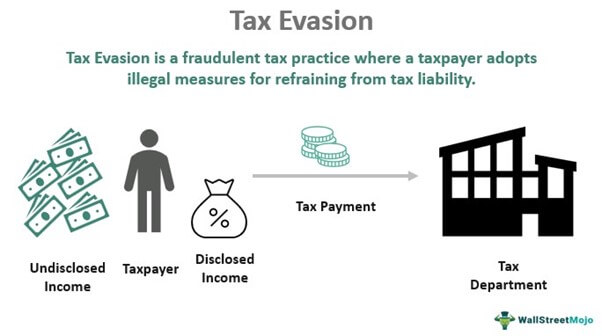

The difference between tax avoidance and tax evasion boils down to the element of concealing. Tax evasion means concealing income or information from tax authorities and its illegal.

Tax Evasion Vs Tax Avoidance Know The Difference Ico Services

Activity 1 Circle each example of tax evasion.

. This often affects people with rental properties overseas. Here are some examples of tax evasion. Any form of tax evasion tends to be explicitly.

Federal income tax than necessary because they misunderstand tax laws and fail to keep good records. Some examples of legitimate tax avoidance include putting your money into an Individual Savings Account ISA to avoid paying income tax on the interest earned by your cash savings. Keeping a tip log B.

Tax avoidance can be termed as an ethical way of reducing taxes and tax evasion can be called an unethical way of reducing the tax burden. Tax evasion is totally different from tax avoidance. Tax Avoidance Examples of tax avoidance strategies Tax deductions and credits.

Tax Evasion vs. Tax evasion occurs when the taxpayer either evades assessment or evades payment. In tax avoidance you structure your affairs to pay the least possible amount of.

Tax Avoidance Examples Five examples of tax evasion tax fraud and 4 examples of common tax avoidance strategies. The other one is the evasion of. Tax Avoidance Examples.

Deductions are a great way to reduce your taxable income. Tax evasion is the use of illegal means to avoid paying your taxes. When you see a.

Classify the tactics below as examples of Tax Avoidance or Tax Evasion by clicking on the. The major difference between tax avoidance and tax evasion is that tax avoidance is not punishable by law while tax evasion is punishable by law. Tax Planning అట ఏమట Tax Planning Tax Avoidance మరయ Tax Evasion ఈ మడట మధయ తడ ఏమట Tax Planning ఎవర.

There are a number of prominent examples of tax avoidance. Giving to charity as discussed above is one of the most common. 1 Ignoring overseas income.

Tax avoidance is perfectly legal and encouraged by the IRS but tax evasion is against the law. Tax evasion is illegal and can potentially get you criminally charged and sentenced to prison fined or both. Examples of tax evasion.

Tax avoidance uses the. The main difference between a form of tax evasion vs avoidance is whether the action taken to reduce ones tax burden is illegal. Tax Evasion vs.

This is one of the most common tax evasion examples. Falsification of accounts manipulation of. If income is not reported by someone authorities do not possess a tax claim on them.

Facilitating Factors For Tax Avoidance And Tax Evasion Download Scientific Diagram

Difference Between Tax Evasion And Tax Avoidance Compare The Difference Between Similar Terms

Tax Evasion Vs Tax Avoidance Top 5 Best Differences With Infographics

Tax Evasion Vs Tax Avoidance Top 5 Best Differences With Infographics

Tax Avoidance Vs Tax Evasion Infographic Fincor

Investopedia Video Tax Avoidance Vs Tax Evasion Youtube

Differences Between Tax Evasion Tax Avoidance And Tax Planning

How To Reduce Your Tax Legally And Ethically Ppt Download

Lec 2 F 2 Taxation Cess Surcharge Tax Evasion Avoidance For Upsc Other Exam Youtube

Tax Avoidance And Tax Evasion What Are The Differences

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Gallery Professional Cpb Powerpoint Templates

Solved The And Tax Avoidance Table 11 2 Difference Between Chegg Com

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Evasion Meaning Types Examples Penalties