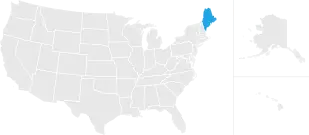

take home pay calculator maine

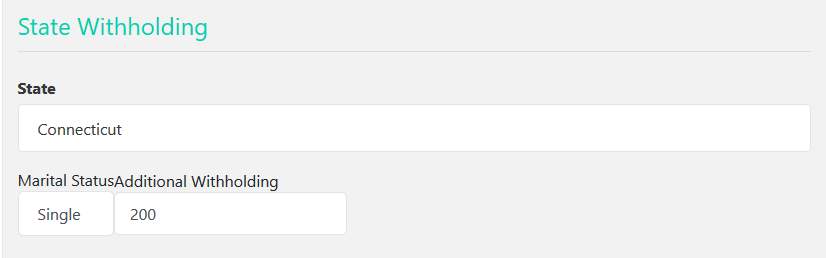

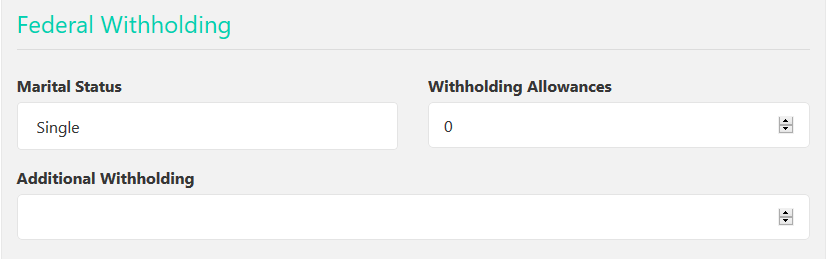

The Maine Salary Comparison Calculator is a good calculator for comparing salaries when you are actively looking for a new job if you would like to compare your current salary to your new salary after a pay raise or compare salaries when looking at a new employment contract maybe you are an expat reviewing different salaries. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Free Paycheck Calculator Hourly Salary Usa Dremployee

Maine allows employers to credit up to 550 in earned tips against an employees wages per hour which can result in a cash wage as low as.

. With all this in mind the total amount that you would take home is 33845. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Maine. Calculate your Maine net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Maine paycheck calculator.

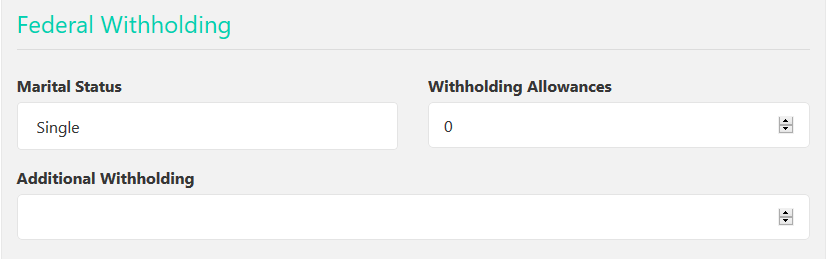

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. How to Calculate Federal Tax and State Tax in Maine in. All you have to do is input wage and W-4 information for each employee into the calculator and let it do the rest of the work.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. For example if an employee has a salary of 50000 and works 40 hours per week the hourly rate is 500002080 40 x 52 2404. Use this free Maine Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest.

Take home pay calculator maine. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates.

The tool provides information for individuals and households with one or two working adults and zero to three children. The assumption is the sole provider is working full-time 2080 hours per year. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

See what youll need to earn to keep your current standard of living wherever you choose to work and live. To use our maine salary tax calculator all you have to do is enter the necessary details and click on the calculate button. Maine Hourly Paycheck Calculator.

Maine Salary Paycheck Calculator. Calculates Federal FICA Medicare and withholding taxes for all 50 states. This means that the applicable sales tax rate is the same no matter where you are in Maine.

This calculator is intended for use by US. In Maine tipped employees such as waitresses bartenders and busboys also have to factor their earned tips into their total wages as well as any tip credits claimed by their employer against their cash wages. Supports hourly salary income and multiple pay frequencies.

It can also be used to help fill steps 3 and 4 of a W-4 form. Maine has a 55 statewide sales tax rate and does not allow local governments to collect sales taxes. Use the following calculation tool to estimate your paycheck based on the stated hourly wages.

How to calculate annual income. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Check out our new page tax change to find out how federal or state tax changes affect your take home pay.

Free Online Houly Paycheck Calculator for 2022. The taxes that are taken into account in the calculation consist of your Federal Tax Maine State Tax Social Security and Medicare costs that you will be paying when earning 5000000. However an annual monthly weekly and daily breakdown of your tax amounts will be provided in the written breakdown.

We want to take the horror out of your payroll tax duties so weve designed a nifty payroll calculator that can figure out all of the federal and Maine state payroll taxes for you and your employees. Our calculator has been specially developed in order to provide the users of the calculator with not only how much tax they will be paying but a. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent Federal State and local W-4 information into this free Maine Paycheck Calculator.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Maine Tipped Wage Calculator. You are able to use our Maine State Tax Calculator to calculate your total tax costs in the tax year 202122.

How Income Taxes Are Calculated. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Maine. Take Home Pay Calculator Maine.

Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. This free easy to use payroll calculator will calculate your take home pay. Then enter the estimated total number of hours you expect to work and how much you are paid per hour.

The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. For example if an employee earns 1500 per week the individuals annual income would be. This salary calculation is based on an annual salary of 5500000 when filing an annual income tax return in Maine lets take a look at how we calculated the various payroll and incme tax deductions.

Based on up to eight different hourly pay rates this calculator will show how much you can expect to take home after taxes and benefits are deducted. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. Maine Salary Paycheck Calculator.

Living Wage Calculation for Maine. Maine Salary Comparison Calculator for 2022. Your household income location filing status and number of personal exemptions.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Start by entering your current payroll information and any relevant deductions. Calculating paychecks and need some help.

Our Maine State Tax Calculator will display a detailed graphical. Compare the Cost of Living in Maine against another US State. This Maine hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you.

Maine Income Tax Calculator Smartasset

Free Paycheck Calculator Hourly Salary Usa Dremployee

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Maine Paycheck Calculator Smartasset

2022 Gross Hourly To Net Take Home Pay Calculator By State

Maine Paycheck Calculator Smartasset

Maine Salary Paycheck Calculator Paycheckcity

Us Tax Calculator 2022 Us Salary Calculator 2022 Icalcul

2022 Filing Taxes Guide Everything You Need To Know

Maine Income Tax Calculator Smartasset

Salary Paycheck Calculator Calculate Net Income Adp

Maine Payroll Tools Tax Rates And Resources Paycheckcity

Free Paycheck Calculator Hourly Salary Usa Dremployee

Free Paycheck Calculator Hourly Salary Usa Dremployee

Free Maine Payroll Calculator 2022 Me Tax Rates Onpay

Salary Paycheck Calculator Calculate Net Income Adp